The U.S. economy is . . . O.K. Sure, inflation’s eating up people’s paychecks. Gas is twice as expensive as it was when Joe Biden left his underground bunker and wandered into the White House. The Dow Jones Industrial Average is down year-to-date. The housing market is cooling off like freshly-baked muffins on a winter windowsill. Uncle Sam is still printing money like it’s going out of style. And Porsche 911’s are still commanding serious money. How serious?

The Porsche premium – $50k to $125k on top of msrp for a new Porsche – is still a thing. And that means pre-loved Porkers are selling for big bucks. Tony’s selling the 15k mile cherry 2015 Porsche 911 GT3 below for $150k-ish. Back in 2015, you could buy a new GT3 for $130k.

That’s $156k in today’s money. Imagine getting all your money back for a car you bought seven years ago – minus any interest payments, insurance and service. Hang on. It’s not quite that good, at least not in this case. Check out the options on this car:

Racing Yellow Paint, 18-Way Adaptive Sport Seats, Full Leather Seat Trim, Sport Chrono Package W/Porsche Track, Porsche Communication Management, Sports Style Footrest In Aluminum, Wheels Painted In Black High Gloss, Standard Side Skirts Painted In Exterior, Porsche Dynamic Light System, Body-Colored Cover Headlamp Cleaning, Front Axle Lifting System, Fuel Tank Cap In Aluminum Look, Vehicle Key Painted, Key Case In Leather, Sound Package Plus, Black Smooth Leather Steering Wheel, Carbon Center Console Cover, Carbon Interior Package, Floor Mats, Passenger Footwell Luggage Net, Smoker Package, Instrument Dials In Guards Red, Illuminated Door Entry Guards, Instrument Dial Sport Chrono Stop Clock, Racing Yellow Seat Belts, Leather Interior Package With Decorative Red Stitching.

I don’t know how much all that finery cost – the leather key case couldn’t have been that expensive – but the front axle lifting system must’ve lifted the Porker’s price PDQ. I’d be surprised if the buyer drove off the lot without leaving $185k in his dealer’s hot little hands.

So we’ve learned two things. One: Porsche’s option sheet is insane and Two: if the GT3 owner gets full whack, he’s down around $30k. Which is $4,285 a year over seven years. He’ll have nothing to complain about.

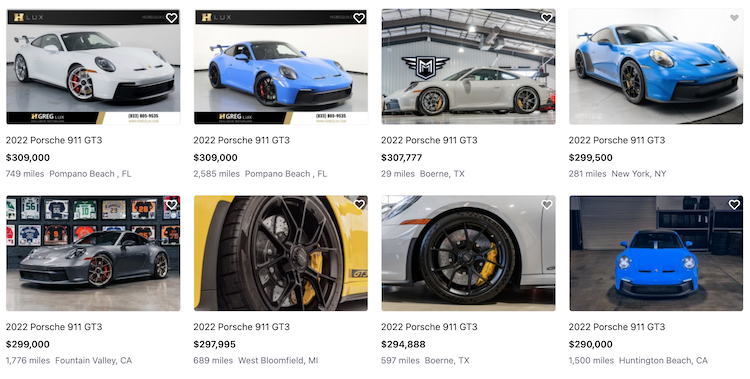

Now if he wants to buy a replacement GT3, that’ll require a lot more money plus a premium. Pulling the trigger on a new GT3 will ding his bank account to the tune of $169,700, plus a $100k premium, for a grand total of $269,700.

If our man gets even a little jiggy with Porsche’s option sheet, he’s looking at a $300k car. No problem! If the wolf comes knocking on his door, at the moment he can turn around and sell it for $330k. Or more.

Running those numbers, I’d say $150 for a seven-year-old banana-colored Porsche GT3 is a bargain. You could say the same for the new $300k GT3. There is literally no problem here. As long as Porsche charges a premium for new 911’s and Boxsters and people are willing to pay it both the old and new cars are worth every penny.

Much to the delight of owners of previous porkers – who might be able to jump to the front of the queue for a new Porsche 911. Not to mention the fact that the dealer premium is a dealer option. As in negotiable. I know a guy who got the $125k premium knocked down to $50k.

I’ve asked it before: is this sustainable? Does the fact that there are no less than 95 pre-owned GT3’s available at duponregistry.com give one pause? That number doesn’t include owners who don’t want to run an ad or tell their car buddies “Dude, I need to sell my car.” So add a third more more to the total. That’s around 126 GT3’s looking for a new home at or around original msrp.

There’s some evidence that prices are softening. We’ve heard of a 911 that didn’t make its money back on BAT. Even so, my favorite Porsche salesman – sorry, order taker – is still showing up for work singing hakuna matata. He reckons buyers can party hearty for at least two more years. And he might be right. Unless and until the economy takes a serious tumble, the status will remain quo. Yes but . . .

What if the Biden administration’s so-called soft landing turns into a nosedive? Porsche owners holding sports cars on the lower end of the price spectrum will rush to market, looking to cash-in for some of that sweet sweet “I got what I paid for it!” cash. Think of it as a kind of four-wheeled bank run.

If the price of Porsches at the lower end sinks lower, it will hurt new car sales. If I can buy a low-mileage picture perfect GT3 for, say $80k, why would I pay $250k for a new one? And if money’s too tight to mention, all those deposits for premium-priced Porsches are, by law, refundable. Buyers will bail. At that point, dealers will quietly extend their “don’t tell anyone” friends and family discount on the premium to enemies and non-relatives. Or drop it entirely.

The key word is quietly. Because anyone who did pay the premium will be plenty pissed. In the short term, the “nudge, nudge, wink, wink” end of the Porsche premium will sustain sales, which will help sustain prices. No premium? Such a deal! In the longer term, I mean, is it possible? Could a Porsche buyer find themselves, gasp, underwater? Owing the bank more than their car is worth? Absolutely.

Back in the day, an average car lost 60 percent of its value over five years. If the value of a pre-owned $300k GT3 drops by anything near $180k, someone’s going to get hurt – especially if they financed the car through Porsche Finance. PF only finances 120 percent of a car’s sticker price (not the premium).

So the GT3 owner would have paid $60k out of pocket for the premium and $13,776 per year in interest, or $68,880 over five years (@ 5.74 percent APR). That’s $128,880 in carrying costs and they’re still on the hook for . . . OMG.

For some people, no biggie. And who knows if my sales guy is right – the current climate may stretch over years. But the Porsche bubble is more like a house of cards. It won’t take much – an economic jolt – to increase Porsche supply and diminish Porsche demand and leave a whole bunch of people SOL.

Call me cautious, but if I could get most of my money back on my seven-year-old 911, I’d do it sooner rather than later. Because as sure as the sun will shine, there will come a time when you can’t. And who wants to be on the wrong side of that day?

The Porsche market is insane! I cashed out after making $25,000 in one year and putting 10,000 miles on a perfectly spec’d 2017 911 S. The logic was that there were a million of them (literally). I will never make $25,000 a year driving a newer 911 again. The buyer sold a year later……RNM at BaT for $15,000 less than what I sold it for and made its way to Champion Porsche, where I would imagine they got close to what he paid for it. I miss that car, and still cannot replace it at any reasonable price. That said, this has to end. I fear that the longer that this continues, the worse that it will end. Once new cars are available, the used cars will stop carrying a premium. If it happens gradually, a crash can be avoided. However, that is not typically how these things end. Typically, when one starts selling others follow and a mass hysteria of selling ensues. Then you wind up with a ton of people underwater on their loans, which accelerates the panic selling. Too much supply and too few buyers…….well we all know what happens then….I’ll give you a clue…..the same hysteria that we see now when there is too little supply, but the opposite direction.